Wage amounts on the final pay stub can be different from the amounts shown on the

Form W-2 for several reasons.

First, some definitions...

Source: PrismHR Customer Resource Center

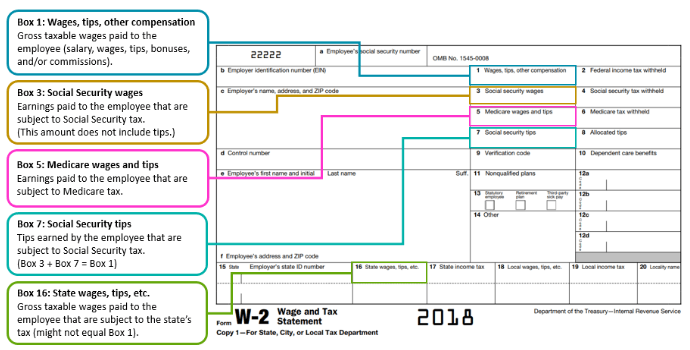

Box 1 ‑ Wages, tips, and other compensation: Gross taxable wages paid to the employee (salary, wages, tips, bonuses, and/or commissions).

Box 3 ‑ Social Security wages: Earnings paid to the employee that are subject to Social Security tax. (This amount does not include tips.)

Box 5 ‑ Medicare wages and tips: Earnings paid to the employee that are subject to Medicare tax.

Box 7 ‑ Social Security wages: Tips earned by the employee that are subject to Social Security tax. (Box 3 + Box 7 = Box 1)

Box 16 ‑ State wages, tips, etc.: Gross taxable wages paid to the employee that are subject to the state’s tax (might not equal Box 1).

Form W-2 vs. Final Pay Stub

Understanding the difference between a final pay stub and Form W‑2 is important. When employees receive their W‑2, they might notice the earnings on their last paycheck stub are different from the reported earnings on their W‑2.

Typically, this is attributed to one of three different scenarios:

- The company offers health insurance that is a pre‑tax deduction. This is the most common reason for the employee’s pay stub earnings to be different from those on the Form W‑2. If the employee participated in the company’s pre‑tax health insurance, the taxable wages in Boxes 1, 3, 5, and 16 will be lower than the amount of the pre‑tax health insurance deduction. Pre‑tax deductions lower the gross wages by the annual amount of the deduction. Example: Jane’s gross wages are $30,000, but during the year she contributed $3,000 to a pre‑tax health insurance deduction. Jane’s taxable Form W‑2 wages are 27,000. (30,000 - 3,000 = 27,000)

- Participation in a company-sponsored retirement plan. These types of plans, such as a 401(k), reduce only the taxable federal and state wages. Those amounts are reported in Boxes 1 and 16, respectively. Example: Sondra’s gross wages are $30,000, but over the course of the year she contributed $2,500 towards her 401(k) retirement. Sondra’s federal and state Form W‑2 wages are $27,500. (30,000 - 2,500 = 27,500)

- Earnings include non‑taxable income items: Non‑taxable income can include reimbursement for mileage or other non‑taxable expenses the employee incurred that were reimbursed to the employee in a payroll. As a result, the gross wages on the employee’s pay stub often differ from the Boxes 1, 3, 5, and 16 wages on the Form W‑2 because the non‑taxable item lowers the gross taxable wages. Example: Maurice’s gross wages are $30,000, but over the course of the year he received $2,000 towards a non‑taxed car allowance. Maurice’s taxable Form W‑2 wages are $28,000. (30,000 - 2,000 = 28,000)

If you have questions about interpreting income boxes or general W-2 questions, please contact LandrumHR's Finance Department at

w2@landrumhr.com.